jordan tax service payments

Credit Card and eCheck transactions are not processed until the payments clear the bank. Total payments and credits add lines 10 through 1200.

JORDAN TAX SERVICE INC.

. This can take anywhere from 2-5 business. My final payment was 5444. For payments made by resident taxpayers to non-residents for taxable activities in Jordan taxpayers must withhold 10 of gross payments and remit this withholding tax to the tax authorities within 30 days after the due date or payment date whichever is earlier.

- Please Select - Baldwin Township Bellevue Borough Braddock Hills Borough Canonsburg Borough Crafton Borough Crescent Township Dormont Borough McKees Rocks Borough Peters Township. Tax and utility bill printing. Download a copy of the residency certification form.

Please click here to return to the main jordan tax service web site. The links below will take you to a third-party payment processing site and will allow you to pay via Credit Card or eCheck. Penalties Late payment fees are imposed at 04 for each week of delay.

A third party processing fee shall apply to Guest Payments. A processing fee may be charged for this service. A penalty of JOD 100 applies for late filing.

As for the corporate income tax the amount is as follows. Electronic Payment Page If you procee you will be leaving the Jordan Tax Service Inc. Online phone POS solutions are available.

Please click here to return to the main Jordan Tax Service web site. 102 Rahway Road McMurray PA 15317 724-731-2300 or 412-835-5243. The second advance payment is due within a period not exceeding 30 days from the last day of the second half of that income tax period.

And comprehensive data accounting banking. Offers comprehensive revenue collection services to all Pennsylvania school districts municipalities counties and authorities including current tax and utility fee collection. Electronic Payments Processing Page.

Pay your Jordan Tax Service bill online with doxo Pay with a credit card debit card or direct from your bank account. In addition payments to non-residents are subject to a national contribution deduction with accordance to the service provider industry ranging from 1 to 7. And comprehensive data accounting banking.

Delinquent tax and municipal claim collection. You can view your Statement Balance and make a payment without enrolling by selecting the Pay Now button. Filing and payment Individual tax returns are due by 30 April following the end of the tax year and any tax due is payable with the return.

Credit Card Electronic Check If all the information on the form is complete you will be redirected to the Official Payments site. Manage all your bills get payment due date reminders and schedule automatic payments from a single app. Doxo is the simple protected way to pay your bills with a single account and accomplish your financial goals.

Fines and penalties Failure to pay tax on the assigned dates according to the provisions of the tax law will result in a delay fine at a rate of 04 of the value of the tax due or any deductible amounts for each full or partial week of delay. Or call 412 835-5243 with any billing questions. Proceed to make Current Sewage payment Municipality.

Rulings There are no tax ruling procedures in Jordan. This can take anywhere from 2-5 business days after the on-line transaction has been. Jordan tax service forms.

Jordan Tax Service Inc. This tax is final. Delinquent tax and municipal claim collection.

If your payment was successful on the Official Payments website please be aware that it will take a minumum of 2 to 5 business days for this payment to be posted to your account. Jordan Tax Service Inc. Jordan tax service payments.

Consolidate and integrate all payments into your accounting software. Offers comprehensive revenue collection services to all Pennsylvania school districts municipalities counties and authorities including current tax and utility fee collection. Jordan Tax Service Inc.

The same rate applies to royalty payments to non-residents. For a complete listing of Utility areas that we service for eBilling Payments click your service type below. Official Payments is our trusted partner and provides a secure environment to process your payment.

Current Earned Income Tax Delinquent Earned Income Tax Admissions Tax Amusement Tax Business Privelege Tax Local Services Tax Mechanical Device Tax Mercantile Tax Per Capita Tax. Real Estate Tax Bill Printing Utility Fee Printing Real Estate Tax Collection Software Home. If your payment was successful on the official payments website please be aware that it will take a minumum of 2 to 5 business days for this payment to be posted to your account.

The WHT rate on services performed by a non-resident juristic or natural person is 10 of the payment. PSN - Your Complete PAYMENT BILLING COMMUNICATIONS Solutions Provider. Payment Processor Credit card and eCheck payments are processed by Official Payments a third-party payment processor.

Jordan Tax Service collects sewage payments and trash collection payments for the Borough of Bellevue. Has been appointed collector for the following Municipalities Taxes. All inquiries must be directed to personnel staffers.

Check this box for direct deposit of your refund00. A processing fee will be charged for this service. Tax and utility bill printing.

We process creditdebit cards eChecks bank-issued checks Check-21 and more. Electronic Payment Posting Credit Card and eCheck transactions are not processed until the payments clear the bank.

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Administering The Value Added Tax On Imported Digital Services And Low Value Imported Goods In Technical Notes And Manuals Volume 2021 Issue 004 2021

Jordan Tax Service Pittsburgh Fill Online Printable Fillable Blank Pdffiller

Jordan First Review Under The Extended Fund Facility Arrangement And Request For A Waiver Of Nonobservance And Modifications Of Performance Criteria And Rephasing Of Access Press Release Staff Report And Statement By The

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Jordan Tax Service Inc About Us

Local And School District Tax Millage

Property Tax Search Taxsys Indian River County Tax Collector

Tax Information Crafton Borough

Quezon City Government Official Website

Earned Income Tax Pine Township Allegheny Co Pa

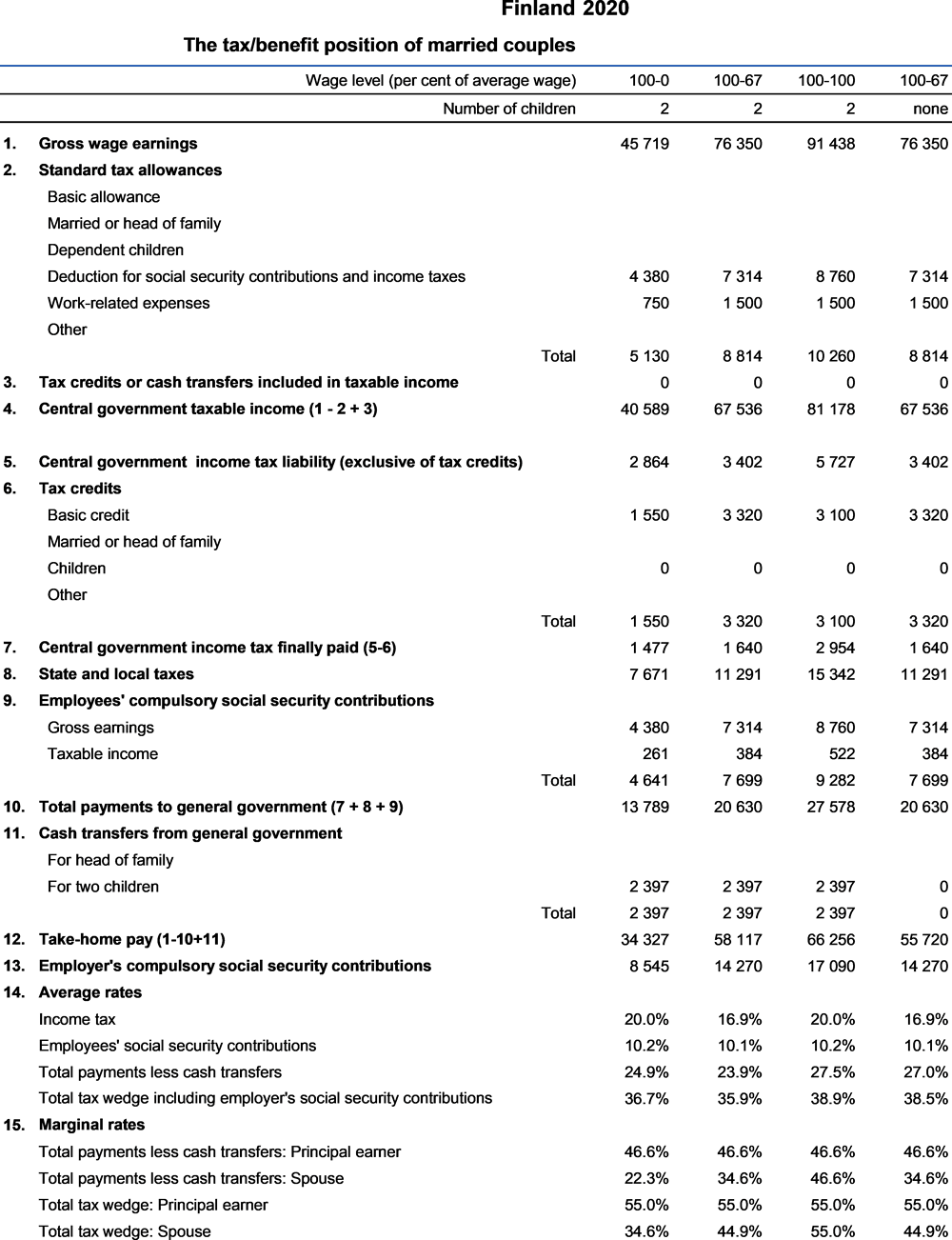

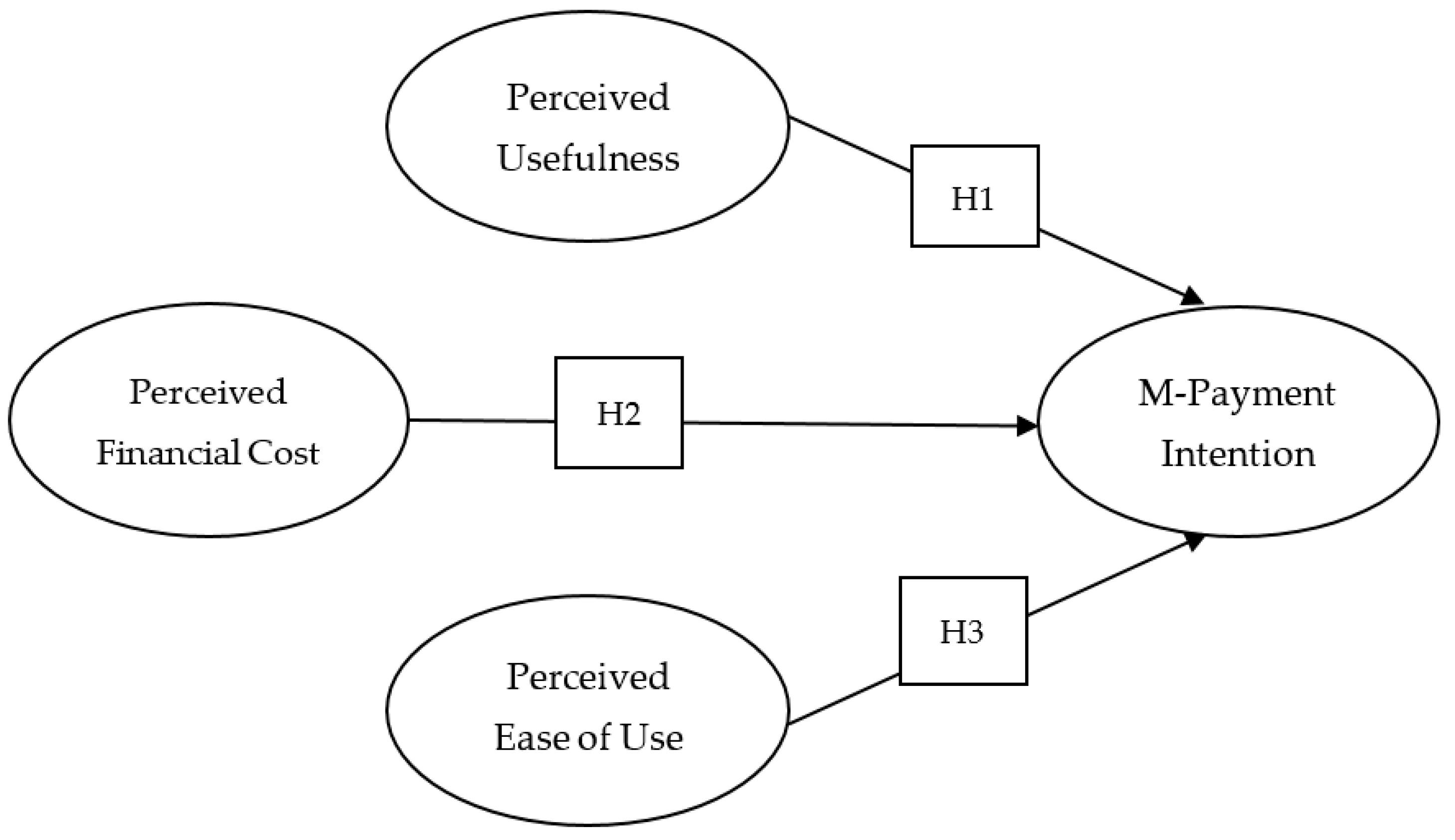

Sustainability Free Full Text Digital Financial Inclusion Sustainability In Jordanian Context Html

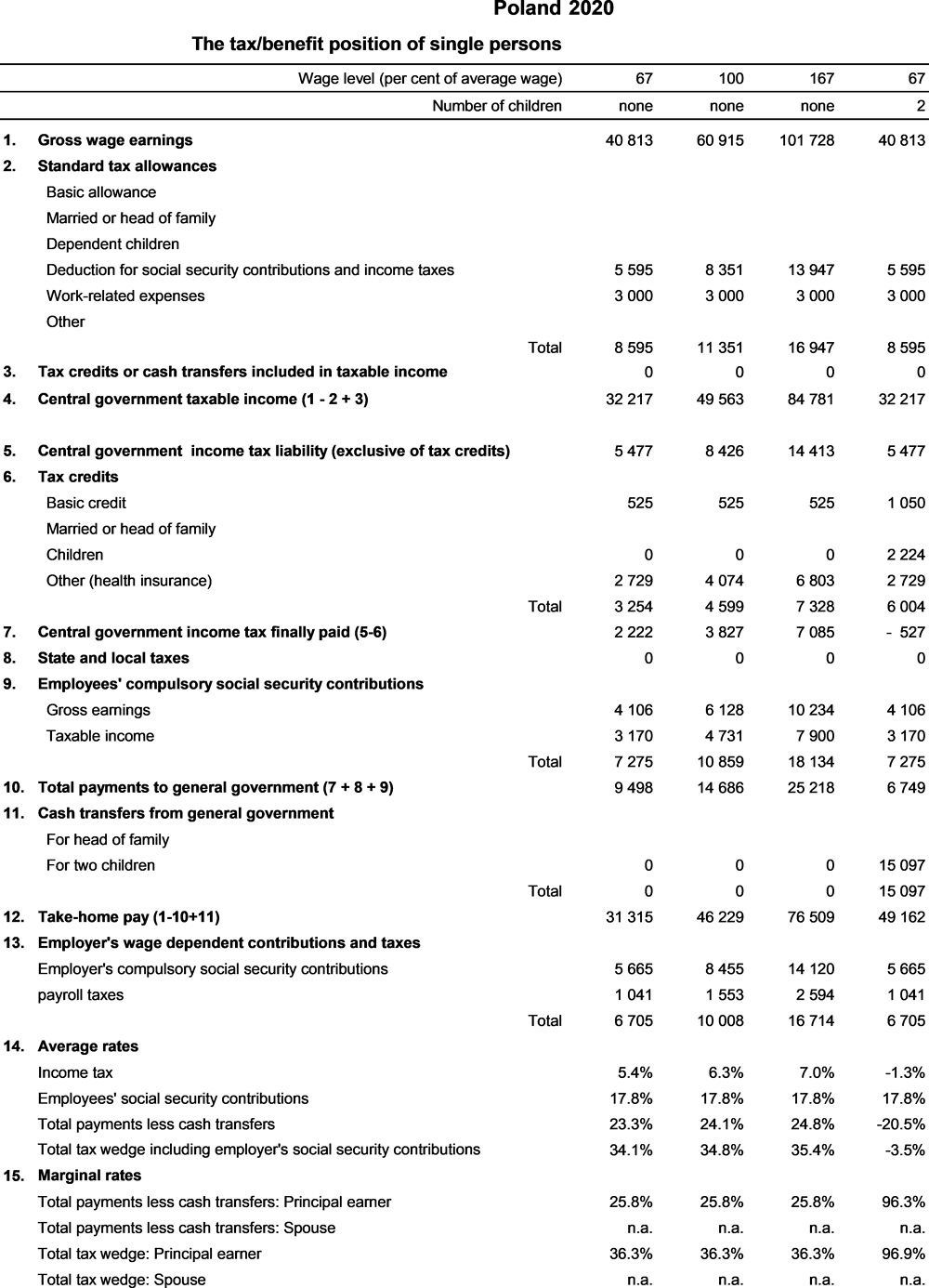

Income And Sales Tax Department